In collaboration with Amplion Inc., we investigated biomarker usage within 24 companies focused on immunotherapy. This article shares exciting insights from our analysis, including which biomarkers are the most popular and how those biomarkers are being utilized by each company.

What is a biomarker? Biomarker, or biological marker, is a term used to describe any measurable biological indicator or characteristic that can reflect a physiological state. More specifically, it has been defined as:

- “a characteristic that is objectively measured and evaluated as an indicator of normal biological processes, pathogenic processes, or pharmacological responses to a therapeutic intervention” (NIH, Biomarkers Definitions Working Group 2001)

- “any substance, structure, or process that can be measured in the body or its products and influence or predict the incidence of outcome or disease” (WHO International Programme on Chemical Safety 2001)

One of the better known examples of biomarkers is seen in diabetes. In 1976, almost two decades after hemoglobin A1c (HbA1c) was first separated from other forms of hemoglobin, Koenig et al. proposed that the molecule could be used to reflect the degree of glycemic control in diabetes patients. This was validated in 1990 when Larsen et al. showed that diabetes could be managed based on levels of HbA1c. Since then, HbA1c has been touted and widely used as the biomarker of choice in clinical trials for assessing the efficacy of antidiabetes drugs (Caveney and Cohen 2011) and is even used in many over-the-counter treatment regimens. Other examples of biomarkers include body temperature for fever, blood pressure for the risk of stroke, prostate-specific antigen (PSA) for prostate cancer, and endophenotypes for schizophrenia.

Biomarkers are now being utilized in drug development and regulatory decision making as they have the potential to improve the efficiency of the drug discovery and development process. In particular, if specific biomarkers that monitor or reflect the status of a disease can be identified, then researchers can use the changes in these biomarkers to better understand how effective the new therapy is against a particular disease. Including that data in a clinical trial would allow researchers to focus their efforts and resources on therapies that prove to be the most effective. In turn, this would reduce the time and cost of bringing a new drug to market. All of these benefits are encouraging to companies in the biopharmaceutical industry.

One field in the biopharmaceutical industry in which biomarkers are proving to have great impact is immunotherapy. Immunotherapy or immuno-oncology is a major focus area for biopharma, and most if not all large biopharma companies have immunotherapy programs. The global immunotherapy drug market was valued at USD 108.4 billion in 2016 and is projected to reach USD 201.5 billion by 2021. Immunotherapy is popular because it allows drug developers to create treatments that use an individual’s own immune system to fight their cancer, completely changing the way the disease is treated. The biggest advantage of this, and the reason that immunotherapies are so useful, is their adaptive nature. As an individual’s cancer develops and mutates, immunotherapies can help the immune system evolve its anti-cancer response by either stimulating components of the immune system that help fight the disease or suppressing procancer signals from cancer cells.

More Than PD-L1

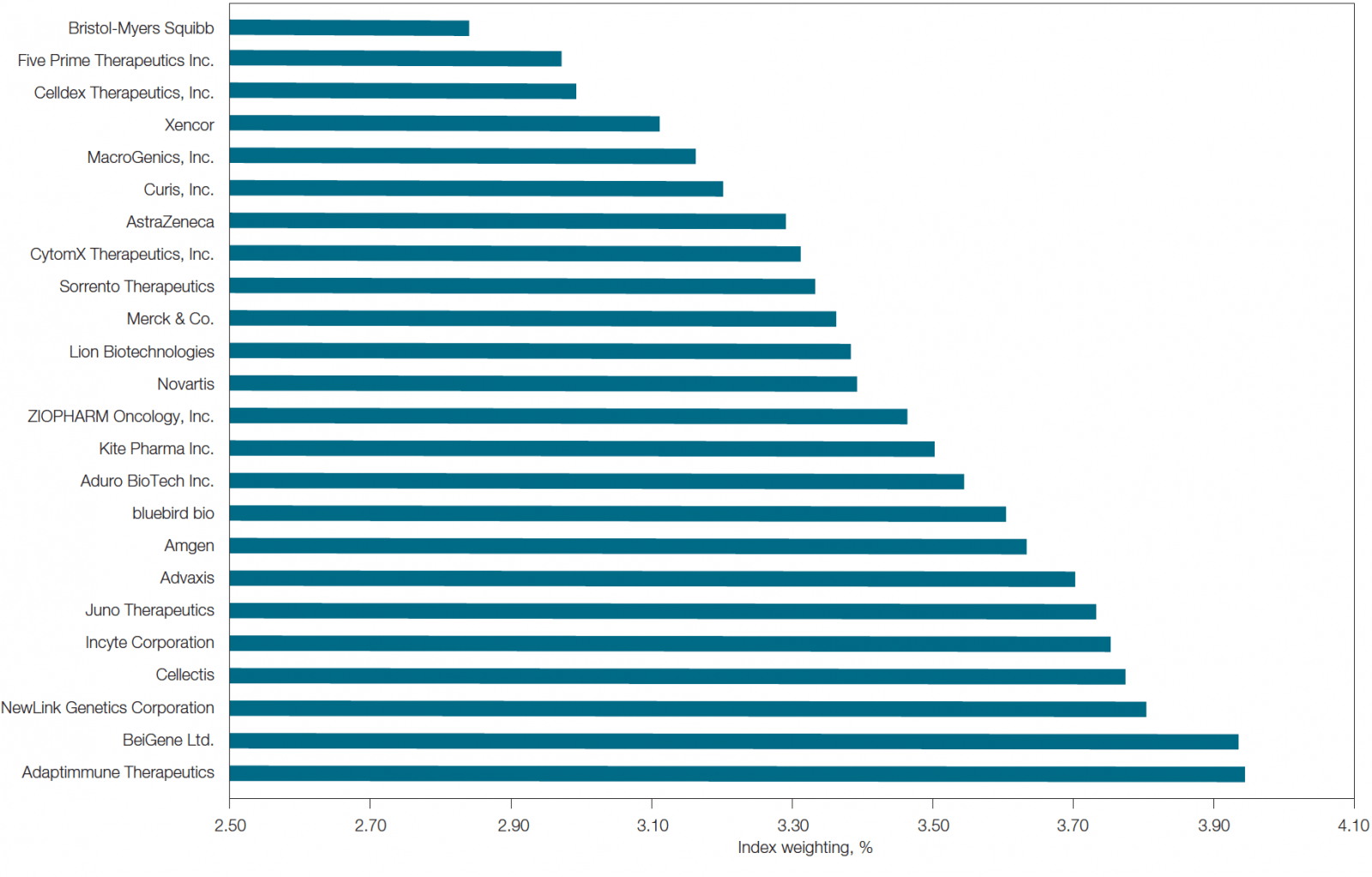

Within immuno-oncology, the most well-known target and cited biomarker is PD-L1 or programmed death-ligand 1. In fact, of the top 24 companies developing immunotherapies (by market capitalization as of February 2017; Figure 1), PD-L1 is the most cited biomarker in their clinical trials. PD-L1 is thought to help cancer cells evade the immune system. In addition, it is also implicated in HIV, lymphoma, sepsis, asthma, and blood disorders. Due to its potential role in cancer, a number of anti-PD-L1 molecules are in development as immunotherapies and have shown promising results in clinical trials (Ma et al. 2016). Market options already using FDA-approved PD-L1 inhibitors include atezolizumab (for bladder cancer and non-small cell lung carcinoma) and avelumab (for non-small cell lung and Merkel cell carcinomas).

Fig. 1. List of top 24 immunotherapy companies by market capitalization. This list was determined using the equal-weighted Loncar Cancer Immunotherapy Index (LCINDX; loncarindex.com), which tracks the progress of new immunotherapies developed by major contributors in the immuno-oncology sector. Data current as of February 2017.

Though PD-L1 is by far the most cited biomarker in clinical trials, 154 other biomarkers are being evaluated for their effectiveness as proxies for prognosis in various diseases (Table 1).

| Name of Biomarker | Number of Mentions/Trial* |

| PD-L1 | 127 |

| HER2 | 56 |

| CD19 | 35 |

| CD8a | 29 |

| PD-1 | 29 |

| NY-ESO-1 | 26 |

| HLA-A2 | 24 |

| CRP | 20 |

| EGFR | 16 |

| TNFα | 15 |

| Ki67 | 14 |

| B7-H3 | 13 |

| PSA | 13 |

| Name of Biomarker | Number of Mentions/Trial* |

| Codanin 1 | 12 |

| KRAS | 12 |

| CD4 | 11 |

| IFNγ | 11 |

| Kynurenine | 11 |

| CD68 | 9 |

| c-Met | 9 |

| FGFR2 | 9 |

| CD3e | 8 |

| ROR1 | 8 |

| BRCA1 | 7 |

| BRCA2 | 7 |

| CD34 | 7 |

* Only biomarkers mentioned seven or more times are listed.

Table 1. List of biomarkers and their use in clinical trials by the top 24 immuno-oncology companies.

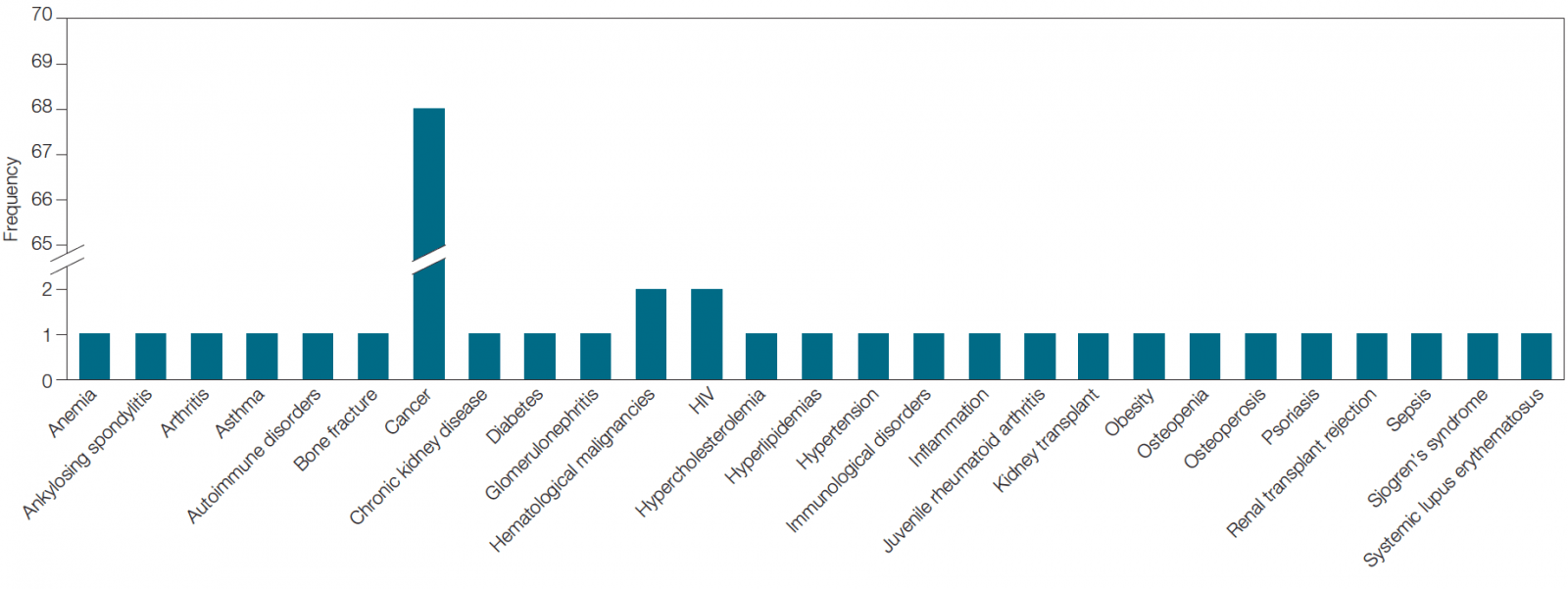

Interestingly, though cancer is the most studied disease (listed ~70 times across clinical trials carried out by the top 24 immunotherapy companies), it is not the only disease for which immunotherapies are being developed. There are 29 other diseases being evaluated in which biomarkers are being used (Figure 2). For example, Bristol-Myers Squibb and Amgen are developing immunotherapies for HIV while Curis and Sorrento Therapeutics are developing immunotherapies for hematological malignancies.

Fig. 2. Diseases being studied across biomarker-associated immunotherapy clinical trials being carried out by the top 24 companies in the field.

Biomarker Indication

Within clinical trials, biomarkers can be classified based on their function, which can be diagnostic, prognostic, and predictive.

- Diagnostic biomarkers can be used to define a population with a specific disease. For example, elevated levels of PSA can be diagnostic of prostate cancer

- Prognostic biomarkers correlate with the progression of a disease. For example, overexpression of HER2 in breast cancer can indicate poor prognosis. These biomarkers can be used as inclusion or exclusion criteria in a clinical trial

- Predictive biomarkers define populations based on their response to a given treatment from an efficacy or safety perspective. For example, HbA1c levels can be predictive of the outcome of a diabetes treatment

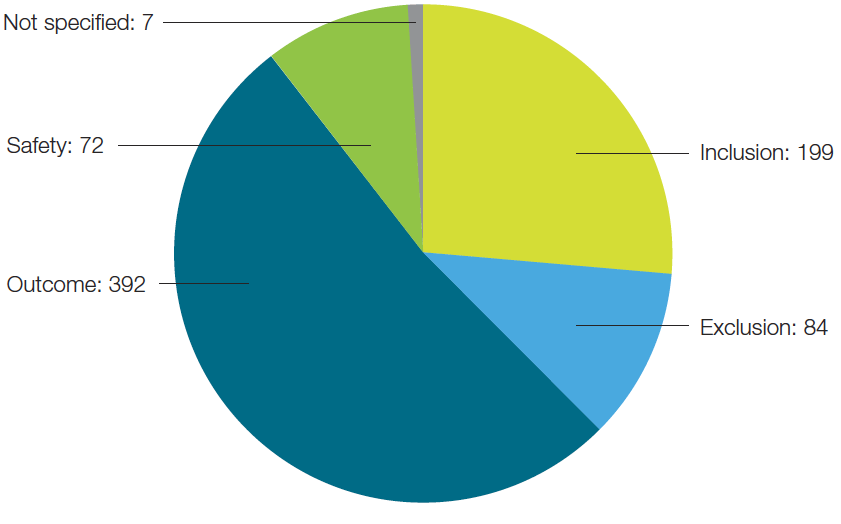

Of the biomarkers being evaluated by the top 24 immunotherapy companies, the majority of them could be categorized as predictive of outcome (Figure 3). This is not surprising as pharma companies are looking to improve the success rates of their clinical trials. By including predictive biomarkers and stratifying patient populations, they can identify patients who will respond to the therapy and thus increase the success rate of the trials.

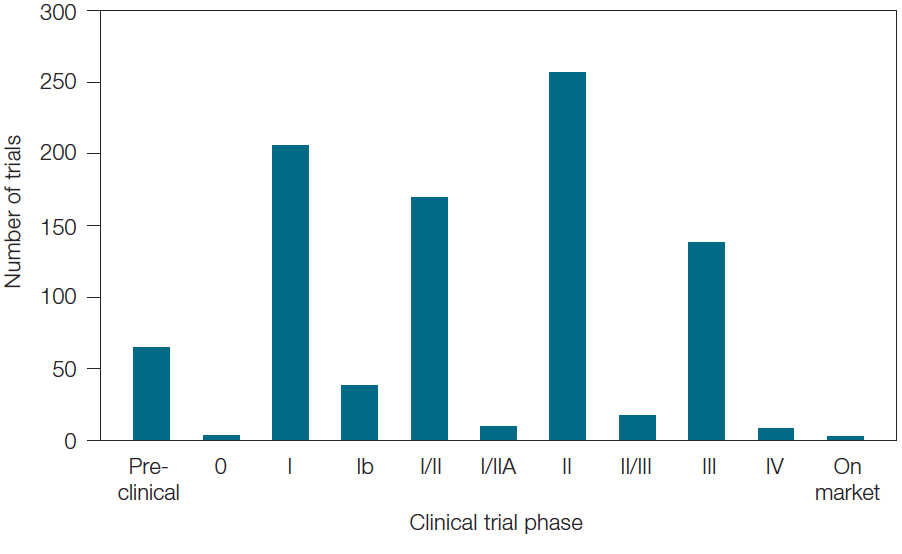

Though immunotherapy is a relatively new field, many of the clinical trials we identified that utilize biomarkers are already moving to later stages (Figure 4). This emphasizes companies’ drive to get these therapies to market in order to be the first to offer new personalized medicines in the continuing race to develop novel treatments for complex diseases.

Fig. 3. Biomarkers segmented by their specific classification.

Fig. 4. Breakdown of immuno-oncology clinical trials utilizing biomarkers by number and phase of trials.

Conclusions

Biomarker intelligence comes from having an overall understanding of disease pathways and the characteristics and features of biomarkers (biomarker landscape) and is required to truly understand the utility of biomarkers. The use of biomarkers in drug discovery and development is increasing. They are being used across all stages, from cell based efficacy biomarkers in early discovery to safety markers in preclinical studies to prognostic markers in clinical trials. Having a thorough understanding of the biomarker landscape and developing strong biomarker intelligence is paying off for companies as they see their costs decrease and success rates increase. Incorporating a biomarker strategy into drug programs is leading to better medicines for all.

References

Biomarkers Definitions Working Group (2001). Biomarkers and surrogate endpoints: preferred definitions and conceptual framework. Clin Pharmacol Ther 69, 89–95.

Cavenery EJ and Cohen OJ (2011). Diabetes and biomarkers. J Diabetes Sci Technol 5, 192–197.

Koenig RJ et al. (1976). Correlation of glucose regulation and hemoglobin AIc in diabetes mellitus. N Engl J Med 295, 417–420.

Larsen ML et al. (1990). Effect of long-term monitoring of glycosylated hemoglobin levels in insulin-dependent diabetes mellitus. N Engl J Med 323, 1,021–1,025.

Ma W et al. (2016). Current status and perspectives in translational biomarker research for PD-1/PD-L1 immune checkpoint blockade therapy. J Hematol Oncol 9, 47.

WHO International Programme on Chemical Safety (2001). Biomarkers in risk assessment: validity and validation. inchem.org/documents/ehc/ehc/ehc222.htm, accessed April 15, 2017.

The data presented here were generated through a collaboration between Bio-Rad Laboratories, Inc. and Amplion Inc. Amplion’s BiomarkerBase tool houses information about biomarkers in clinical use and provides a forum where this information is readily accessible.

BiomarkerBase is a trademark of Amplion Inc.